Whenever someone tells you about Share Market you would imagine all those large companies profit or losses that flashes over television screens. It is not simple to understand Share Markets, it takes several years of understanding the working of Share Markets.

What is Stock / Share Market ?

Share market is nothing but a place where companies invest their stocks and distribute their profits or losses. Whenever you invest in a company by buying some of its share, you become a legal co-partner of the company and whenever the company makes profits you get some of it based on investment. But it is not necessary that the company will always make profits, sometimes it goes in loss leading to heavy losses of the investors.

What is Stock Exchange ?

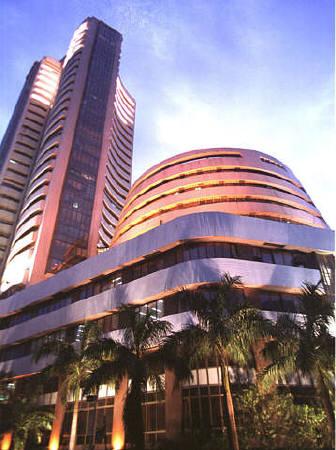

Stock exchanges are places where companies give out their shares to people. BSE (Bombay Stock Exchange) is the oldest and largest stock exchange in India. NSE (National Stock Exchange) in Mumbai is second largest.

List of Indian Stock Exchanges

- Bombay Commodity Exchange (estwhile the Bombay Oilseeds and Oils Exchange)

Bombay Stock Exchange (BSE)

Calcutta Stock Exchange (CSE)

Cochin Stock Exchange

Inter-Connected Stock Exchange of India (ISE)

Multi Commodity Exchange of India (MCX)

National Commodity & Derivatives Exchange (NCDEX)

National Stock Exchange of India (NSE)

OTC Exchange of India (Exchange for Technology and Growth Stocks)

Pune Stock Exchange (PSE)

How to invest in Stock Market ?

Common people cannot directly go to NSE (National Stock Exchange) or BSE (Bombay Stock Exchange) to invest their money. They do it indirectly through brokers. Brokers are certain people who on request check for availability if shares for a specified company and buy shares. If no share is available brokers insist BSE or NSE to check if someone is interested in selling his/her shares. Once you have invested your money you are ready to check companies profits or losses.

Let us take an example to understand this

Suppose a company XYZ is doing well and you would like to buy some shares. Suppose XYZ gets 75 % investment from shares and sells 750 shares each share of Rs 10, 000. Now if you buy 75 shares paying 7.5 lakhs then you own 7.5 % on the investment that XYZ overall makes and you will receive 7.5 % of total profits that the company will make. Remember if the company falls your shares will also fall. Experienced people thus anticipate the situation and try to sell out their shares to avoid losses. The newbies are often trapped in losses.

What is Sensex and Nifty ?

Sensex and Nifty are indexes to specify how well the market is performing. Sensex has 30 companies listed by BSE. If these 30 companies are making profits then market is doing well and there are chances of profits for other companies and vice-versa. Same way Nifty has 50 companies and the list is maintained by NSE. Dow Jones and NASDAQ are US indexes to specify the performance of market.

Factors determining Profits or Losses

While there are several thousands factors affecting profits or losses. One thing you must know that you have just invested in a company and that does not make you a member of decision-makes on how the company will invest or make profits, you are just a member who invests. So how company performs to earn profits is a major tactics of share market.

Other factors include how well the economy performs. If the performance of economy is not good then there are severe chances of losses. Imports and Exports to and from an economy plays an important role in affecting stock. If export value is greater than import value then it is favorable balance of trade. In such cases share market generally does well but still it is not necessary that you earn profit. May be your company in which you invest earns profits on imports.

Country's currency also plays an important role in affecting share market. US Dollar is considered as the index by most of the countries to check if the currency is strong or weak. Rupee has shown significant fall in the last 3 decades. Because of this prices are continuously rising leading to continuous collapse of share market.

Economy also depend on how much gold, silver, crude oil or diamond reserve a country have. Crude oil and gold reserve in India is low in comparison to other countries.

No effect how much brokers claim for strategies to earn you profits, there is no such strategies. Luck is the most important factor that really matters.

Your comments are most welcomed.

Nice blog. It is necessary to know about the share market before investing in share market. You can use free trial for dealing in share market. If you want to use free trial click here >> Ripples Advisory

ReplyDeleteNice Blog!

ReplyDeleteThanks for sharing such great information for more update visit us at

CapitalHeight

Thankyou for providing us information about https://24cfin.com/equity-tips. Your blog is very informative and beneficial for all the traders who are trading in share market.

ReplyDelete

ReplyDeleteThe 50-share index has had a wobbly start to November series. share-tips-expert

Great article thanks for sharing such a useful information in it. I have suggestion for new investment planner and trader safe your investment with wealth research financial services. They have best researcher team and they providing 90% exact share market level. You see the level and you decide how to invest in share market.

ReplyDeleteMCX TIPS

FUTURE BTST / STBT

This comment has been removed by the author.

ReplyDeleteI always read your blog. Your blog information is always correct and valuable. Stock market is the easiest way to make profit but you want the best stock market advisor. So, visit Epic Research limited.

ReplyDeleteThanks for providing this post. Share market courses in chennai is best choice for beginners.

ReplyDeleteTheory of the blog is different from others as I have read hundreds of blogs and articles but found such essence nowhere. Impressive writing and deserve a title of unique writing skill.

ReplyDeleteShare Market Online Trading In India

Online Shares Trading Platforms In India

Thanks for sharing valuable information

ReplyDeleteStock Market Courses in Delhi

Stock Market Institute in Delhi

Share Market Training in Mumbai

Share Market Courses in Mumbai

Share Market Classes in Chennai

This blog is very informative. keep posting.

ReplyDeleteFree Commodity Tips.

Thanks for share with us. Keep up the good work and keep share Free Stock Tips.

ReplyDeleteThanks for sharing this kind of information. Wealth research providing the best Option Trading in a share market. We are setting the target of share and first, you see the target than decide how to invest in the share market. Options trading for experiencing the accuracy of our services just fill the free trial from here and make your trading risk free.

ReplyDeletestock market courses in Delhi

Stock Market Institute in Delhi

Share Market Training in Mumbai

Share Market Courses in Mumbai

Share Market Classes in Chennai

Thanks for sharing information about stock marketing. This one is very clear blog for beginners

ReplyDeletecapital market training coourses in chennai, option strategies courses, derivatives training, financial education in school,Basic of investing in mutual funds